Customized financial models templates

We create financial models for various types of projects and business

Customized Financial Model

A management tool

Financial models are a powerful management tool with a wide range of applications, including strategic forecasting, company analysis, sensitivity analysis, and scenario analysis.

Part of a business plan

A financial model is a valuable tool that can help you assess the potential of your business idea by estimating its earning potential and the capital requirements needed to make it a success.

Part of a business case

A financial model is a powerful tool that can help you assess the potential impact of a new product line or capital expenditure (Capex) on the overall performance of your company.

Three Statement Financial Model

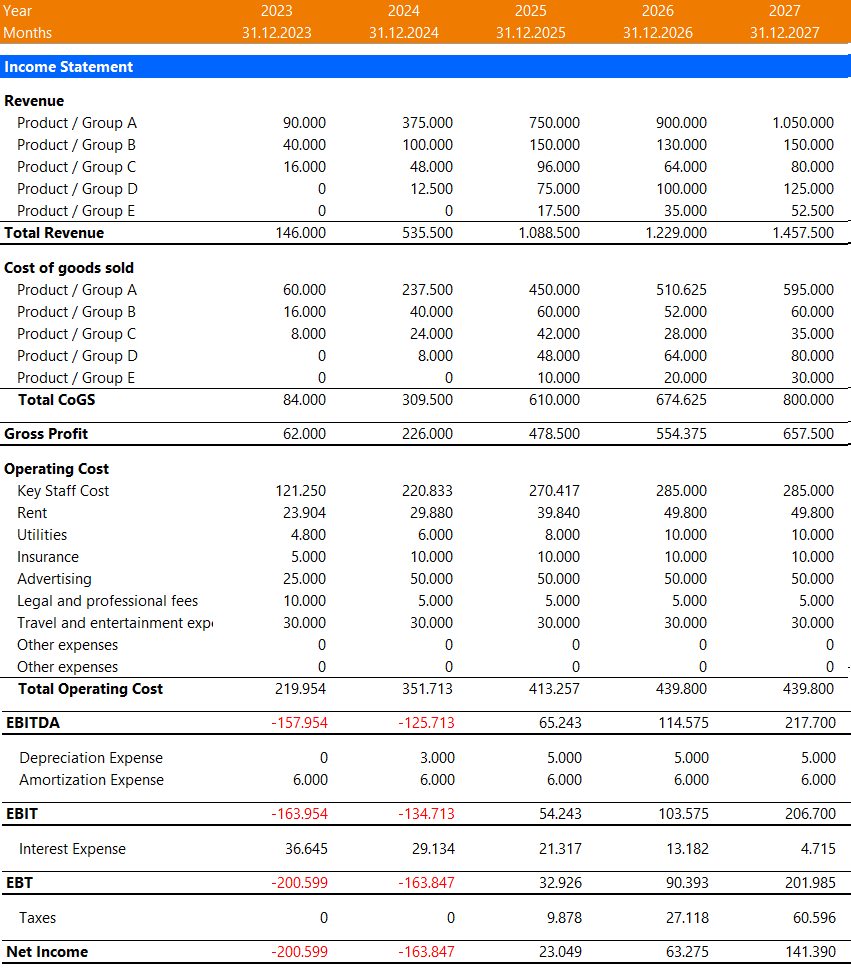

Income Statement

The income statement shows the company's revenue, expenses, and profitability over a specific period.

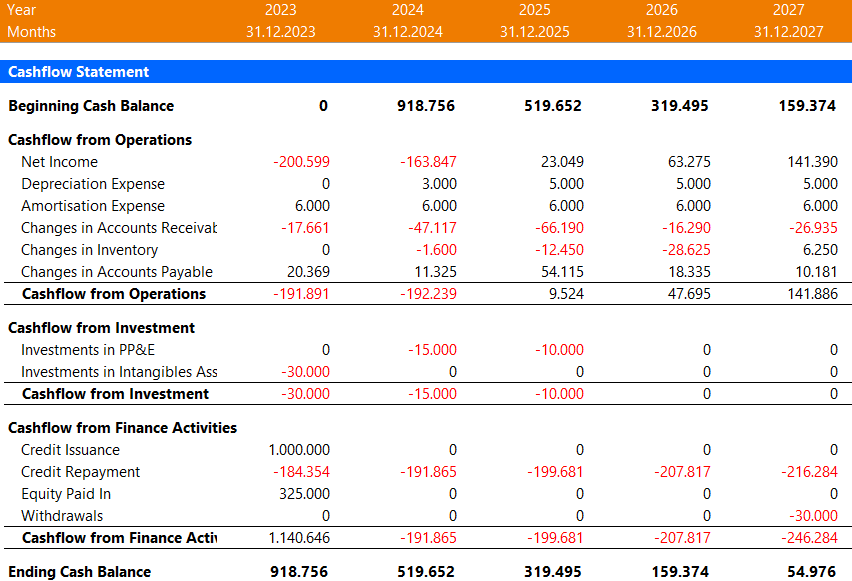

Cashflow Statement

The cash flow statement shows how much cash a company has generated or used during a specific period, from operating activities, investing activities, and financing activities.

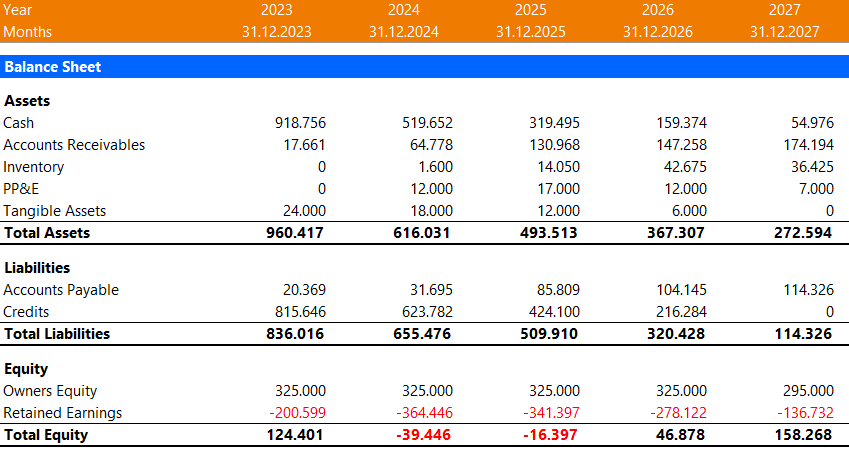

Balance Sheet

The balance sheet is a financial statement that shows a company's assets, liabilities, and equity at a specific point in time, providing a snapshot of its financial position.

Our financial model is designed to be flexible and customizable to meet the unique needs of your business. We have divided our model into the following parts:

Revenue Model

We understand that the revenue model is a critical aspect of your financial model. It reflects your business model and strategy and plays a crucial role in your company’s financial success. We know that different types of businesses have different revenue models. For instance, a retail shop will estimate its revenue differently from an online store or a software as a service (SaaS) business. That’s why we offer a specialized service to help you evaluate your business model and build a tailored revenue model based on your preferences and parameters.

Cost of goods sold (COGS Model)

Our COGS model offers a lot of financial modeling potential that can be customized to your specific business needs. Depending on your overall business and revenue model, we can incorporate more complex production aspects such as workforce and workshop capacities, economy of scale, capacity scaling, and inventory management.

We have experience in building financial models that include a manufacturing model. We understand that production plans may not always align with sales, especially for products with long lead times. That’s why we take a comprehensive approach to COGS modeling, ensuring that all aspects of your business are accurately reflected in the model.

Operating Expenses - Staffing Model

We understand that staffing costs can be a significant cost block for most businesses. That’s why we offer a dynamic staffing model, that is easy to update and customize based on your specific needs.

For smaller team sizes, we focus on a role-based approach to staffing. For larger companies, we include the management team and department costs. We also incorporate the potential linkage between the revenue model and the cost of goods sold in our staffing model. This is especially useful for high-growth companies, as our model can automatically add staff members based on sales volume and production capacities, making it a valuable tool for managing your workforce and controlling costs.

Operating Expenses - Customer Acquisition Cost / Marketing Expense

Calculating marketing expenses can be complex, and it depends on your business model and target customers. For example, a company that sells B2B equipment will most likely have a direct sales team, and their marketing costs will mainly be related to travel costs, some ads, and trade shows.

On the other hand, an e-commerce business will have a stronger focus on marketing, with a marketing funnel that is focused on online ads, affiliate marketing, impressions, clicks, and conversion rates. The customer acquisition cost will be different for new clients and returning customers, and both need to be considered in the customer acquisition cost model.

Our financial model can help you accurately estimate your marketing expenses based on your unique business needs. We take a comprehensive approach to marketing modeling, ensuring that all aspects of your marketing strategy are accurately reflected in the model.

Operating Expenses - Other costs

These costs can include office rent, legal costs, accounting, and other operating expenses that need to be accurately modeled to get a complete picture of your business finances.

To accurately model these costs, we use a comprehensive approach that includes modeling each cost as an individual line item. This allows us to allocate costs differently over the year and accurately reflect the impact of these costs on your overall cash flow.

For example, office rent can be simulated with a hurdle rate that considers the staff capacity and the timing of the rent payments. We also consider the impact of costs, which are often charged at the beginning of the year and can have a significant impact on your cash flow. By accurately modeling these other costs of running a business, we can provide you with a comprehensive financial model that will give you the insights you need to make informed decisions about your business.

CAPEX, Depreciation & Amortization

Our financial model offers a simple and efficient way to track your investments in equipment, hardware, and software developments. With our model, you can easily name each individual investment, select a purchase month, a useful lifetime, and a rest value. The model will then calculate the related depreciation and amortization expenses and update the book value on a monthly basis, giving you a clear picture of your company’s financial health.

Workig Capital

Running a business isn’t just about generating revenue – managing your working capital is also critical to keeping your cashflow healthy. This is especially true for businesses working in a B2B environment, where purchases on invoices are commonplace and customers often pay bills up to 60 days later. To balance this, we need to make sure we pay our suppliers within a certain time period, while also taking care of regular monthly expenses such as payroll and rent.

Another important factor in working capital management is inventory. As we discussed in the CoGS model, there are different ways to calculate inventory levels, including raw materials, products in progress, and finished goods. We’ll keep track of all these inventory types to ensure that we have the right amount of stock on hand to meet customer demand without tying up too much capital in excess inventory.

To help you stay on top of your working capital, we’ll maintain monthly balances for accounts receivable, accounts payable, and inventory.

Debt & Equity Model

With our model, you can input your initial equity and simulate monthly additions or withdrawals to get a clear picture of your equity position. This allows you to plan and manage your finances more effectively, ensuring that you have the funds you need to keep your business moving forward.

Managing debt is a bit more complex, but our model has you covered there too. We can view debt as a total debt balance or simulate individual credits with different durations, interest rates, and repayment terms. This level of detail helps you understand your debt position better and make informed decisions about how to manage your debt.

Finally, we understand that unexpected cash flow issues can arise, which is why our model includes a line of credit that automatically activates if your monthly cash flow becomes negative. This feature ensures that you have the necessary funding to weather any temporary cash flow challenges.

Taxation

While we are not tax attorneys, we can conservatively estimate your tax levels at the end of the year and predict monthly payments. This allows you to plan and budget for your tax obligations and avoid any unpleasant surprises come tax season.

If your company has initial losses, we can simulate tax breaks and move the loss balance forward to the next period. This helps you optimize your tax position and reduce your tax liability where possible.

Financial Ratio Analysis

In order to ensure that the financial assumptions of our model are reasonable, we conduct a ratio analysis. This analysis involves calculating various financial ratios, including profitability ratios, liquidity ratios, and debt ratios, to evaluate the financial health and performance of the business.

To supplement our ratio analysis, we have defined additional ratios that we use to verify if the growth rate of revenue matches other operating expenses. These ratios act as sanity checks, ensuring that our financial assumptions are in line with industry standards and market conditions.

Our goal is to provide you with a comprehensive financial model that accurately reflects your business’s financial position and performance. By conducting a ratio analysis and using additional ratios to check our assumptions, we can ensure that our model is reliable and provides the insights you need to make informed business decisions.

Financial KPIs

Income Statement KPIs

- Revenue Growth Rate

- Gross Profit Margin

- Net Profit Margin

- Earnings Before Interest and Taxes (EBIT)

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

- Operating Expense Ratio

- Cost of Goods Sold (CoGS) Ratio

Cashflow & Balance Sheet KPIs

- Current Ratio

- Quick Ratio

- Debt-to-Equity Ratio

- Debt-to-Asset Ratio

- Return on Equity (ROE)

- Return on Assets (ROA)

- Days Sales Outstanding (DSO)

- Inventory Turnover Ratio

Industry KPIs

- Average Revenue per User

- Customer Lifetime Value

- Sales Conversion Rate

- Monthly Recurring Revenue

- Churn Rate

- Average Order Value

- Asset Utilization Rate

- Revenue per FTE

Financial Model Structure

Assumption Sheet

In this section, you input all of the crucial assumptions for the financial plan, such as prices, costs, and investments. This table acts as the central control for the entire financial model.

Calculation Sheet / Model Sheet

The calculation tab is where all the number crunching takes place, organized into different blocks such as Revenue, Cost of Goods Sold, Staff, Depreciation, and more.

Monthly Financial Statements

The financial plan includes a monthly Income Statement, Cashflow Statement, and Balance Sheet for typically 60 months.

Annual Financial Statements

The financial plan outlines the expected income, cash flow, and assets and liabilities for a period of 5 years through the Income Statement, Cash Flow Statement, and Balance Sheet.

Funding / Valuation Sheet*

The funding sheet summarizes the required funding and any funding shortfall by period. Additionally, a discounted cash flow (DCF) model is employed to calculate the potential value of the company. *Optional

Dashboard*

The Dashboard visually displays key elements of the financial model through graphs, charts, and performance indicators, making it ideal for presenting to potential investors or for use in loan applications.

Excel File / Google Sheets

We provide you with an editable Excel financial model file, which includes all the relevant segments and formulas for reconciliation. You'll be able to update the model yourself and make changes as needed.

PDF Reports

Our financial models are designed to be easily printable, making it easy for you to share your plan with partners, banks, and investors.

Financial Plan / Business Case Process

Our process includes the following steps:

- Understanding your business model and key drivers, so that we can accurately capture the essence of your business in the financial model.

- Creating a blueprint of the model structure, ensuring that it is tailored to your specific needs and requirements.

- Building the first draft of the financial model, using the information and data we have gathered in the previous steps.

- Revisions with you, to make any necessary adjustments and ensure that the model is a true reflection of your business.

- Thorough review of the entire financial model, checking formulas, formatting, and creating printouts for ease of use.

- Providing training and support to one or more people in your organization on how to use the financial model effectively

With our expertise and attention to detail, we ensure that the financial model accurately represents your business and supports decision-making.

Our financial modeling services

Remote / Onside Meetings

We offer both remote and on-site services at your location, using effective tools such as Teams, Zoom, and Excel Live to guarantee a smooth and productive work process.

Simply formulas & calculations

We offer a service that prioritizes simplicity and user-friendliness in financial modeling. Our models are designed to be easily followed and edited by our clients, without the use of overly complicated formulas.

Industry best practice

We offer a comprehensive business case development service, ensuring accuracy and informative results. Our financial model checklist guarantees the correct form and logical flow in the creation of the business case.

Modular Design Approach

We provide customized financial modeling services for your business. Our process involves utilizing pre-built and proven "Building-blocks" for about 70% of the model, while the remaining 30% will be tailored specifically to meet the unique requirements of your business model.

Example pictures of a basic financial model

Income Statement

Cash Flow Statement

Balance Sheet

Further articles that we recommend:

https://levermann.com/financial-model/financial-statements-guide/

https://levermann.com/financial-analysis/financial-ratios-guide-101/

The Use of Sensitivity Analysis and Scenario Analysis in Your Business Strategy Explained

Business Strategy Defined Business Strategy is the framework that defines the company’s goals and the direction and ways to achieve these goals. It is an

The Use of Financial Statement Analysis in Business Decision Making

What is Financial Statement Analysis Financial statement analysis evaluates a company’s value through its historical data in the three basic financial statements. These are the.