Accounts Receivable, or AR, is a crucial part of any business. It is an essential asset of the company as it is a potential cash inflow to fund its operations or finance long-term acquisitions. Once the customers pay, the amount owed is canceled from the AR account and added to the company’s cash.

It is vital that Business Owners fully understand how Accounts Receivable affects their business and how they can best manage and maximize its use in a manner most beneficial to the company.

In this article, Accounts Receivable refers to Trade Receivable. This is created through the day-to-day and regular sales transactions. It is differentiated from Other Accounts Receivable or Note Receivable. Other Accounts Receivable is a collectible that doesn’t fall under trade or regular transactions such as employee advances. A Note Receivable, on the other hand, pertains to debts tied to formal documentation such as a promissory note.

Understanding Accounts Receivable

Accounts Receivable is used in the accrual basis of accounting which better reflects the actual results of the business operations. It is an asset account created when a business sells its products or services on credit to customers to be paid later.

The difference between cash basis accounting and accrual basis of accounting is based on when your revenue and expenses are reflected in your books. When using the cash method of accounting, you wouldn’t recognize accounts receivable or accounts payable. Therefore, it will be challenging to keep track of cash, making cash flow management a challenge.

Accrual accounting allows you to match up revenue and related expenses starting when the transaction occurs rather than when payment is transferred.

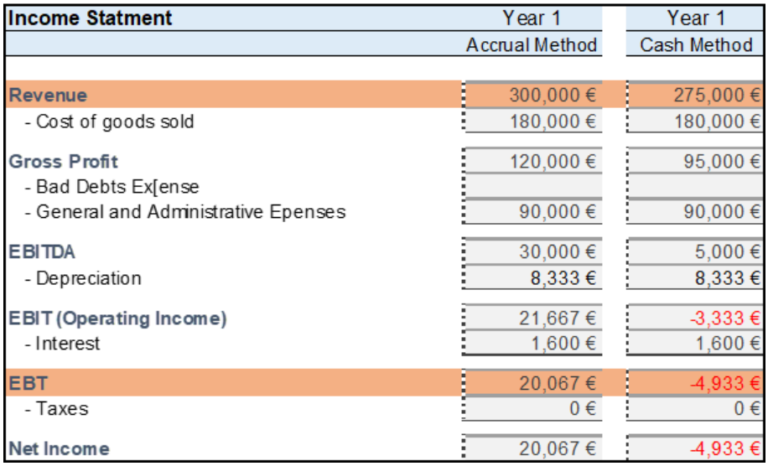

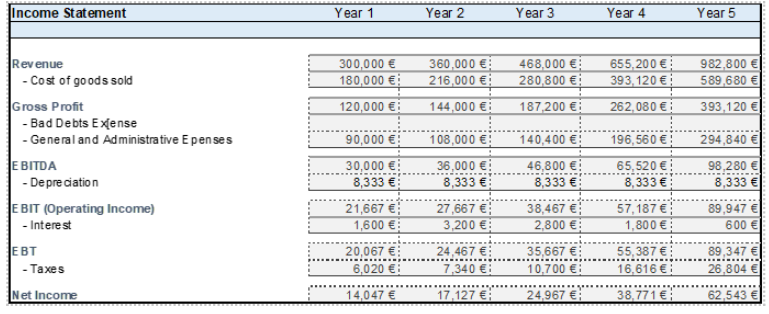

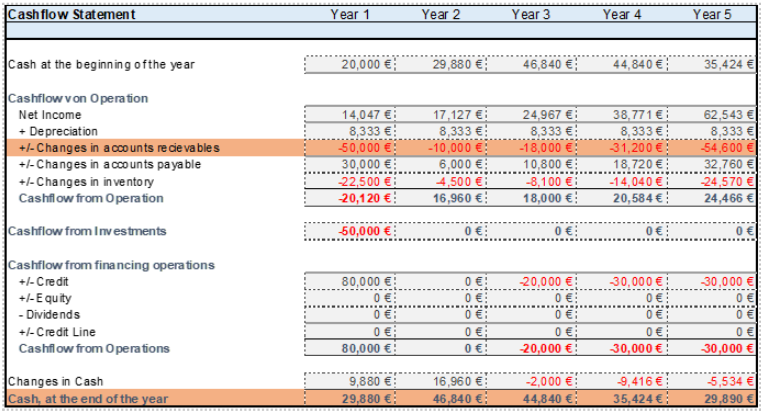

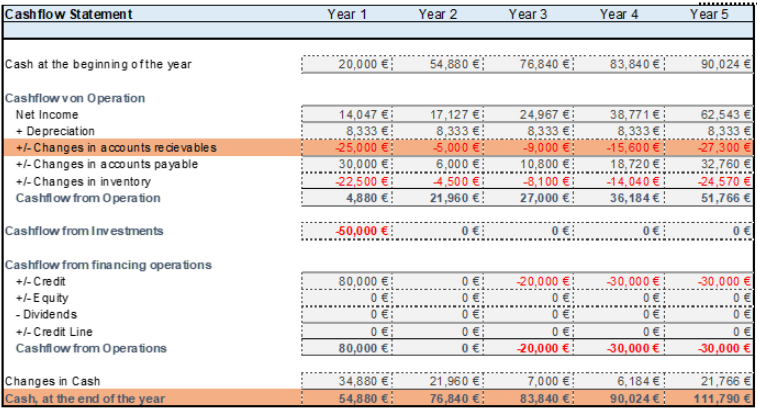

Below is a comparison of how financial statements are presented under the accrual and cash methods. All other accounts are the same except for the amount recognized as revenue and the corresponding amount booked as accounts receivable. For example, the company sold €300,000 worth of office chairs, of which only € 275,000 was paid in Year 1 and the remaining €25,000 to be collected in Year 2.

Under the accrual method, € 300,000 is recognized as revenues, while only the cash/paid sales of €275,000 is recognized under the cash method. With all other accounts equal, earnings before taxes are €20,067 under the accrual method or €25,000 higher than the reported earnings under the cash method, which is a negative €4,993.00. This €25,000 is equivalent to the unpaid sales in Year

For illustration purposes and to clearly illustrate the effect of the cash method in the income statement, income tax expenses were disregarded. However, should the tax authority in the country allows tax computation based on the computed taxable income, whether it is the cash or accrual method, we note that the company will already pay the taxes for the reported income even if the same still needs to be collected.

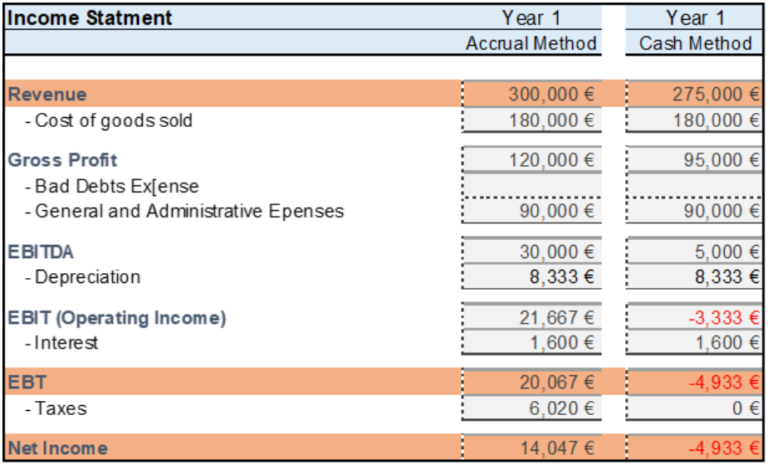

Below is the illustration with the tax computation. Note that the net income after tax under the accrual method is €14,047 versus net loss after tax under the cash method of €4,933, assuming an income tax rate of 30%.

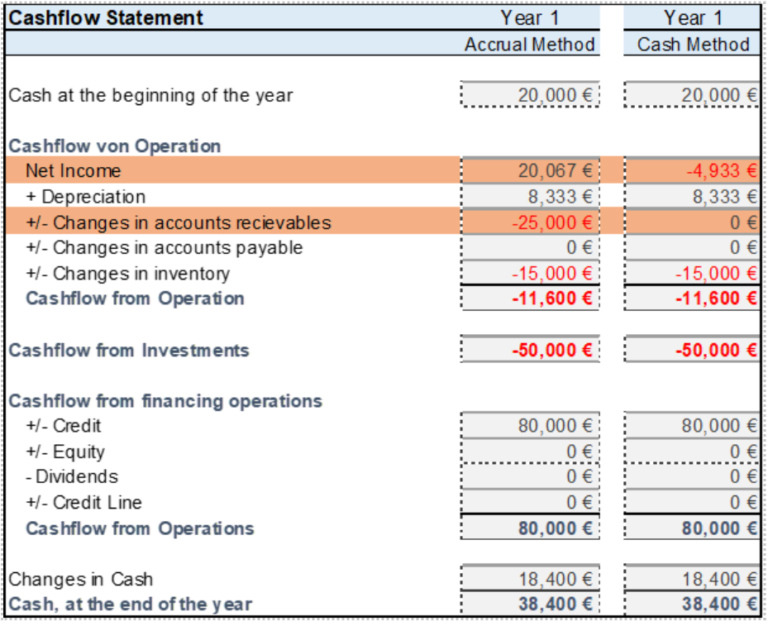

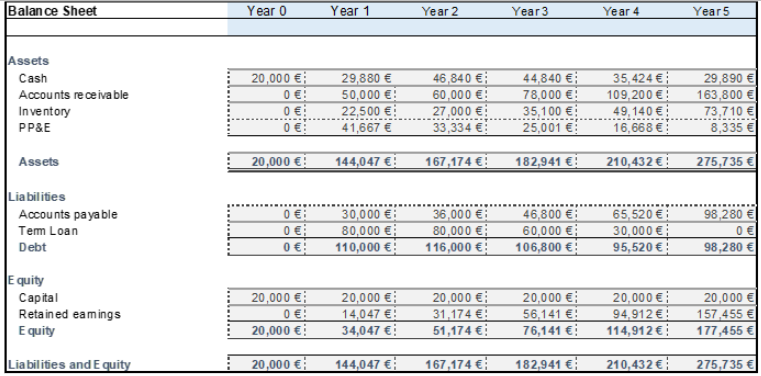

As previously discussed, the net income difference of €25,000 between the accrual and cash methods is due to the $25,000 unpaid sales in Year 1. But we note that this was offset by recognizing the accounts receivable under the accrual method. Hence, we computed the same ending cash balance of €38,400.00.

However, suppose we consider the tax paid under the accrual method, which included the €25,000 unpaid sales. In that case, the company will be paying higher taxes which will eventually be a deduction from its cash flow. However, this is just a timing difference, as the corresponding tax will eventually be deducted under the cash method during the Year the amount is collected.

Defining the Accounting Treatment for Accounts Receivable

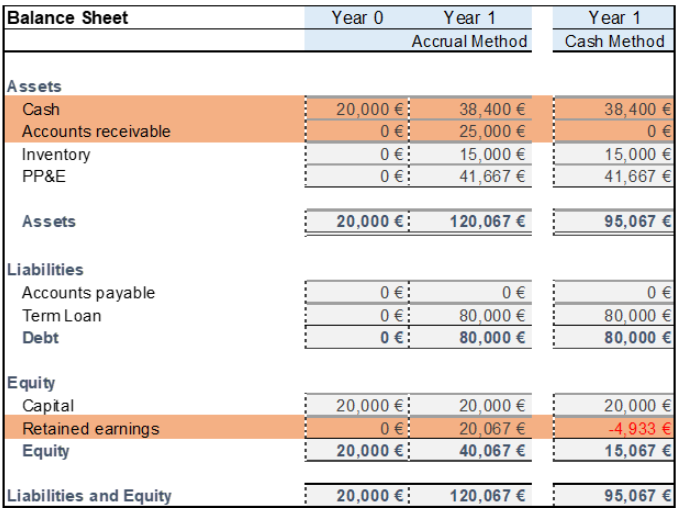

As noted above, under the accrual method, the unpaid sales of €25,000 is reported as Accounts Receivable, resulting in higher total assets compared to the cash method. The retained earnings show the net income booked under each method.

Accounts Receivable is commonly paired with the allowance for doubtful accounts, a contra account that provides the reserves for possible bad debts. The effects of such a provision will be looked into further in the latter portion of this article when the impact of bad debts is discussed.

Identifying Accounting Principles Concerning Accounts Receivable

The following are basic accounting principles that guide the handling of Accounts Receivable in financial statements:

- Revenue Recognition Principle. Revenue should be recognized upon the delivery of the products or completion of the service, regardless of whether payment is already received or still to be collected. Accounts Receivable is recorded when revenue on credit is recognized.

- Matching Principle. The cost incurred in generating revenues should be entered into the books in the same period as the revenue is recognized. This means all costs of goods linked to sales is booked at the time of the sale, even for those sold on credit, and Accounts Receivable is created.

Determining the Impact of Credit Terms on the Business

Credit terms are the terms of payment established by the seller and represent the buyer’s commitment to when he will pay for the goods and services. The credit term could vary from 7 days, 15 days, and 30 days to a few months. These are affecting the company’s cash flow and profitability. Long payment terms may result in delayed cash inflow, affecting the company’s ability to meet its obligation to pay business expenses. On the other hand, while short payment terms favor the company’s cash position, some customers may be discouraged from patronizing the company’s products and services. This, in turn, may subsequently reduce the company’s revenues and expected cash flow.

Credit is usually granted to attract more customers and increase market share. However, if some of them pay late or do not pay at all, they might hurt your business. Late customer payments are one of the top reasons companies get into cash flow or liquidity problems. Expanding the credit offered to customers exposed the company to the risk of higher bad debts. Also, higher receivables and longer credit terms increase the working capital requirements of a business.

Thus, a company must find that balance among many considerations that will be most beneficial to the business. For example, they may offer different payment terms to various customers based on their creditworthiness and relationship with the company. A company may also offer incentives for customers to pay early, such as discounts.

It may make sense to extend credit to customers even when some must be written off as bad debts if these sales generate profits exceeding the bad debt losses. When products generate substantial profit margins, they may offer credit to most customers because the profits are substantial, and they exceed the possible amount of bad debts. Conversely, when the profit per unit is relatively low, a business can only afford a few bad debts, so it must be cautious in extending credit to customers.

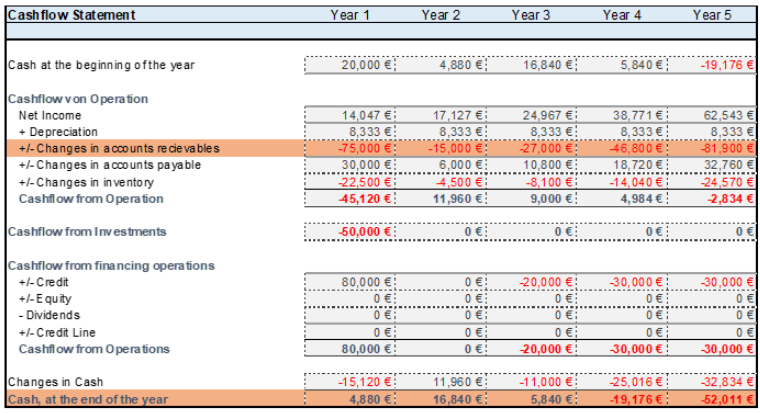

The following financial statements assume that the credit term is 60 days.

Knowing the Effect of Bad Debts on the Business

If a company sells on credit, some customers may be unable to settle their obligations. Bad debt is incurred when a company fails to collect Accounts Receivable. This will result in reduced revenue and lower net income. It is likewise possible that there will be additional expenses in the collection effort, such as legal fees, collection agency fees, and manpower costs. Therefore, a company must carefully assess its customers’ creditworthiness, closely monitor receivables, and proactively collect from customers.

Assessment should be made as to how many uncollected debts a company typically incurs so that provisions or estimates can be set aside and charged to operations periodically.

The bad debt expense is an expense account that will be shown as a deduction to revenues in the income statement. The corresponding credit account is the allowance for bad debts account. This is shown as a deduction to the reported accounts receivable in the balance sheet.

Assessing credit risk is vital in the accounts receivable equation. Knowing your company’s financial position and cash flow requirement is critical because generating more revenue by offering credit terms exposes the company to higher collection risks.

A business’ credit terms offer must be dependent on its confidence as to the certainty that the amount will be collected and converted to cash. Therefore, a thorough assessment of the customer’s creditworthiness is essential.

Using Relevant Financial Ratios

Financial ratios can help the company assess the status of its Accounts Receivable and take the appropriate actions.

The Accounts Receivable Turnover Ratio calculates how many times a business is able to collect its average Accounts Receivable over a year. It is a method of determining if the company is able to attain the desired collection efficiency, given its success in converting receivables into cash within the prescribed credit terms. We derive AR Turnover Ratio by dividing the credit sales by the average accounts receivable.

Let us look at the previously presented Balance Sheet and compute the AR Turnover Ratio in Year 2.

Managing Accounts Receivable Efficiently

The company must carefully evaluate its credit policy and ensure the timely collection of its receivables since sales has no value if there is no cash collected. The following are steps that will be helpful:

- Communicate the payment terms to customers clearly and correctly to avoid confusion and manage expectations.

- Closely monitor AR Aging Reports, with periodic review and assessment, to identify which accounts must be prioritized.

- Conduct regular and consistent follow-ups on late payment incidents to prevent these from becoming bad debts.

- Offer rebates and other benefits to encourage prompt payments.

- Keep accurate and up-to-date data to have a basis for timely decisions and appropriate actions.

A financial model is a valuable tool for Business Owners to help them better understand how accounts receivable may affect cash flow, liquidity, and profitability. In addition, a good financial model is helpful in forecasting and managing future cash flow and identifying areas and options for utilizing Accounts Receivable.

We at Leverman Consulting can help you design a suitable financial model that will maximize the benefits of Accounts Receivable. We will be glad to discuss and fully understand your business so we will know how best we can help build your financial model.