Your Guide to Goodwill Accounting

Introduction

Intangible assets refer to assets of the company that are not physical in nature. They cannot be seen or touched. Instead, they represent a company’s intellectual property, such as patents, copyrights, trademarks, or brand recognition.

Intangible assets have become increasingly important to companies and investors over the years. As the business landscape evolves, companies have found that their intangible assets can represent a significant portion of their value. This has led to a need for a better understanding and accounting for these assets.This shift in the business landscape has increased the focus on intangible assets. Companies are now placing a higher value on these assets and are looking for ways to leverage them to create value. For example, companies are investing in research and development to develop new patents and trademarks to help them differentiate themselves from their competitors. They also invest in marketing campaigns to build brand recognition and customer loyalty.

Investors are also paying more attention to intangible assets. They recognize that these assets can be a significant source of value for companies. For example, a company with a strong brand and customer base will likely have a competitive advantage over its competitors. This can lead to higher profitability and growth.

There are two main classifications of intangible assets.

- Definite life intangible assets are those with a finite life. An example is a license to produce a product for 15 years, which is subject to asset amortization. They may also become impaired over time, at which point the company will recognize an impairment expense and reduce the asset’s value on its balance sheet.

- Indefinite life intangible assets are those whose life is unknown at inception. They may generate or contribute to revenue in perpetuity. These intangible assets are not usually subject to amortization but to an annual impairment test.

Amortization of intangible assets is an activity by which the cost is expensed or spread over the asset’s life. The concept is similar to the depreciation of tangible assets.

Goodwill Defined

Goodwill is one of the most common and significant indefinite life intangible assets on a company’s balance sheet. It arises when a company acquires another company for more than its fair value. The surplus between the purchase price and the fair value of the acquired company’s net assets represents goodwill. This premium could be due to the value of an established market share, an efficient distribution system, brand recognition, a talented workforce, or customer loyalty.

Accounting Treatment of Goodwill

Accounting for goodwill has been challenging with diverse views on the subject. Before 2001, goodwill was subject to amortization over 40 years. However, the Financial Accounting Standards Board (FASB) issued Statement No. 142, which discontinued the amortization of goodwill. Instead, goodwill is now subject to annual impairment tests.

The impairment test requires companies to assess the fair value of their reporting units and compare it to the unit’s carrying value, including goodwill. In case the fair value is less than the carrying value, then the company must recognize an impairment loss in its income statement and reduce the carrying value of the goodwill on the balance sheet.

It is worth noting that since 2014, private companies have had the option to amortize goodwill for up to ten years. However, if a private company chooses to amortize goodwill and then decides to go public, it must restate all its financial statements.

One of the reasons for the change in the accounting treatment of goodwill is that it is difficult to measure. Goodwill is not something that can be directly measured or observed. Instead, it is a value derived from the company’s reputation, brand, customer base, and other intangible assets. This means that it is subject to a high degree of estimation and subjectivity.

Another reason for the change is that it reflects the shift in the business landscape. In the past, companies relied heavily on tangible assets like factories, machinery, and real estate. However, as the economy has become more service-oriented, intangible assets have become increasingly important. As a result, companies now rely on their intellectual property, brand, and customer base to create value.

Illustration

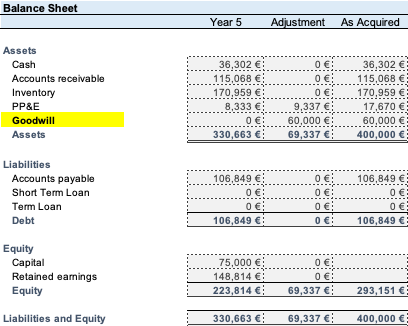

For example, let us assume that at the end of Year 5, Company Z offered to acquire ReneOffice.Solution for 400,000 €. The table below shows that the total assets stood at 330,663€.

Assessment of the fair market value of its assets showed that its PPE has a market value of 17,670€. The transaction will result in the goodwill of 60,000 €, giving importance to the developed loyal and solid customer base and the established distribution system that earned strong brand recognition over the last five years.

Company Z can subject the goodwill to impairment or amortization. If the company decides to impair the goodwill, it must conduct an annual impairment test to assess whether the reporting unit’s carrying value exceeds its fair value. In case the fair value is less than the carrying value, then the company must recognize an impairment loss in its income statement and reduce the carrying value of the goodwill on the balance sheet

However, if Company Z decides to amortize the Goodwill, it must recognize an expense of 6,000 € per year for the next ten years, assuming a ten-year life and must be expensed over that period.

Conclusion

In conclusion, intangible assets, especially goodwill, are crucial to a company’s balance sheet. Goodwill arises when a company acquires another company for more than its fair value. It represents the excess purchase price over the fair value of the acquired company’s net assets. The accounting treatment of goodwill has been a subject of debate for a long time. Therefore, companies must understand goodwill’s accounting treatment well to ensure accurate financial reporting. It is recommended that companies consult a licensed accountant for guidance on the appropriate accounting treatment.

(Note: This article is for general information purposes only. The accounting treatment for goodwill may vary depending on the country and the accounting standards adopted by a company. It is recommended to consult a licensed Accountant for guidance on the appropriate accounting treatment)