Financial Plan / Business Case

Template:

Product Sales via Website / E-Commerce

When it comes to selling products directly to customers, there’s no one-size-fits-all approach. That’s because different products, industries, and types of customers have different needs. So, it’s important for each business to have a financial plan or business case that’s specifically designed for them. For example, a company that sells fancy coffee beans is going to have a different approach than a company that sells bikes for kids to learn on.

Every business is unique. Example:

For a successful high-end coffee bean business, it’s important to focus on building a strong relationship with your customers. This means paying close attention to the bean roasting, packaging, and shipment process.

When creating a financial plan or business case for this type of business, it’s crucial to take into account both the revenue from new clients (through advertising and conversion efforts) and the recurring revenue from loyal customers (through customer retention strategies).

Additionally, it’s important to carefully consider the operational aspects of the roasting and packing process, as well as any production constraints that may impact your ability to sell your products. Remember, you can only sell what your team is able to handle.

Different business models, require different financial plans.

It’s important to note that each type of business, whether it be a coffee bean business, a dropshipping business, or an apparel business, will have its own unique needs and requirements. This is why it’s crucial to have a tailored financial plan or business case for each individual business, in order to accurately reflect its specific needs and goals. By comparing the differences between these types of businesses, it becomes clear that a one-size-fits-all approach is not effective

Financal Model

E-Commerce / Product Sales-

Personal consultation

-

Explaination & coaching

-

Valuation & Funding

-

Fully editale files

We create financial models for various types of projects and business

A management tool

Financial models are a powerful management tool with a wide range of applications, including strategic forecasting, company analysis, sensitivity analysis, and scenario analysis.

Part of a business plan

A financial model is a valuable tool that can help you assess the potential of your business idea by estimating its earning potential and the capital requirements needed to make it a success.

Part of a business case

A financial model is a powerful tool that can help you assess the potential impact of a new product line or capital expenditure (Capex) on the overall performance of your company.

Financial Model Structure

Assumption Sheet

In this section, you input all of the crucial assumptions for the financial plan, such as prices, costs, and investments. This table acts as the central control for the entire financial model.

Calculation Sheet / Model Sheet

The calculation tab is where all the number crunching takes place, organized into different blocks such as Revenue, Cost of Goods Sold, Staff, Depreciation, and more.

Monthly Financial Statements

The financial plan includes a monthly Income Statement, Cashflow Statement, and Balance Sheet for typically 60 months.

Annual Financial Statements

The financial plan outlines the expected income, cash flow, and assets and liabilities for a period of 5 years through the Income Statement, Cash Flow Statement, and Balance Sheet.

Funding / Valuation Sheet*

The funding sheet summarizes the required funding and any funding shortfall by period. Additionally, a discounted cash flow (DCF) model is employed to calculate the potential value of the company. *Optional

Dashboard*

The Dashboard visually displays key elements of the financial model through graphs, charts, and performance indicators, making it ideal for presenting to potential investors or for use in loan applications.

Excel File / Google Sheets

We provide you with an editable Excel financial model file, which includes all the relevant segments and formulas for reconciliation. You'll be able to update the model yourself and make changes as needed.

PDF Reports

Our financial models are designed to be easily printable, making it easy for you to share your plan with partners, banks, and investors.

Product Sales via Website / E-Commerce

Customized Financial Plan

Revenue & sales channels we which we will consider for your e-commerce business

Direct sales through company-owned website.

Selling products on e-commerce platforms such as Amazon or Etsy.

Implementing market-based pricing strategies.

Providing volume discounts or free shipping for first-time orders.

Offering loyalty programs and discounts through newsletters.

Offering complementary or higher-priced products to existing customers.

Offering a subscription-based product delivery service at regular intervals.

Implementing market-based pricing strategies.

Selling products through affiliate partners such as content creators or influencers.

Offering Google Ads Campaigns to drive traffic and generate sales.

Marketing through social media platforms.

... and many more things we can consider

Operation, product & inventory aspects we consider in e-commerce

Manufacturing products in-house

Outsourcing product manufacturing.

Designing products in-house.

Using an external company for product design services

Owning and operating an in-house warehouse and packing team for shipment purposes.

Outsource warehousing and shipping to a third-party provider.

Management of returned products

Handling of warranty claims

Determining the necessary personnel for warehouse and operational needs.

Funding for inventory and purchases

Preparing for seasonal demand changes through pre-production.

... and many more things we can consider

Get a customized financial model for partners, banks & investors

Our financial modeling process

Our process includes the following steps:

- Understanding your business model and key drivers, so that we can accurately capture the essence of your business in the financial model.

- Creating a blueprint of the model structure, ensuring that it is tailored to your specific needs and requirements.

- Building the first draft of the financial model, using the information and data we have gathered in the previous steps.

- Revisions with you, to make any necessary adjustments and ensure that the model is a true reflection of your business.

- Thorough review of the entire financial model, checking formulas, formatting, and creating printouts for ease of use.

- Providing training and support to one or more people in your organization on how to use the financial model effectively

With our expertise and attention to detail, we ensure that the financial model accurately represents your business and supports decision-making.

Our financial modeling approach

Industry best practice

We offer a comprehensive business case development service, ensuring accuracy and informative results. Our financial model checklist guarantees the correct form and logical flow in the creation of the business case.

Modular Design Approach

We provide customized financial modeling services for your business. Our process involves utilizing pre-built and proven "Building-blocks" for about 70% of the model, while the remaining 30% will be tailored specifically to meet the unique requirements of your business model.

Remote / Onside Meetings

We offer both remote and on-site services at your location, using effective tools such as Teams, Zoom, and Excel Live to guarantee a smooth and productive work process.

Simply formulas & calculations

We offer a service that prioritizes simplicity and user-friendliness in financial modeling. Our models are designed to be easily followed and edited by our clients, without the use of overly complicated formulas.

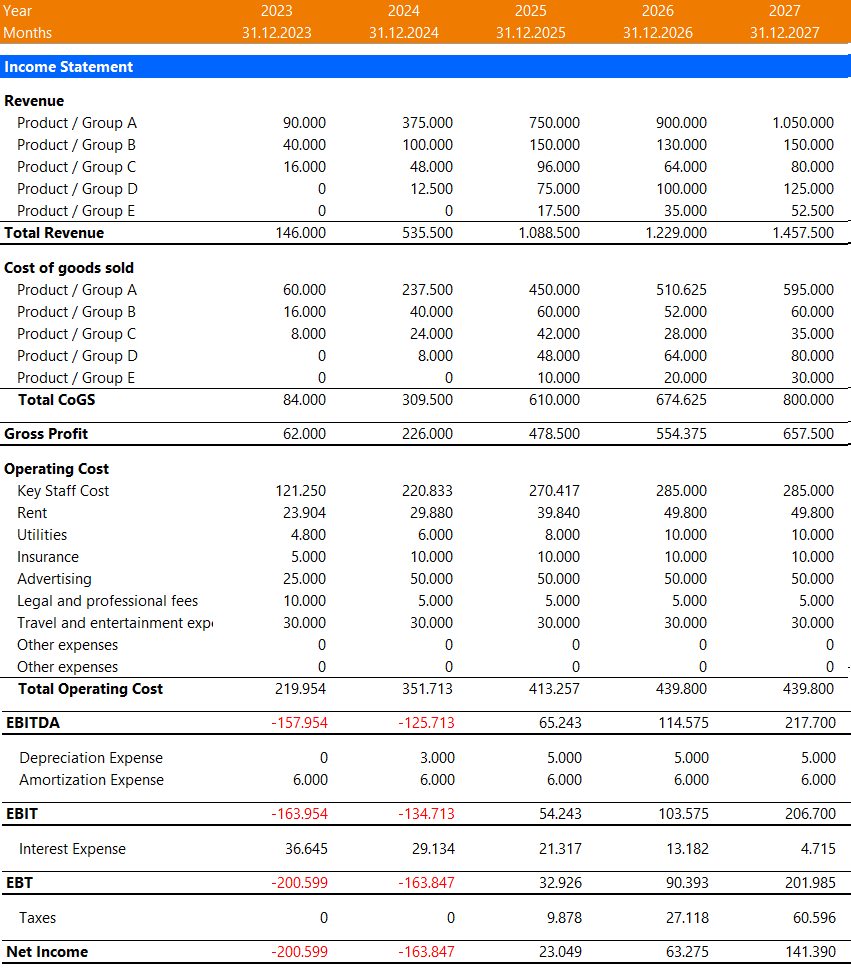

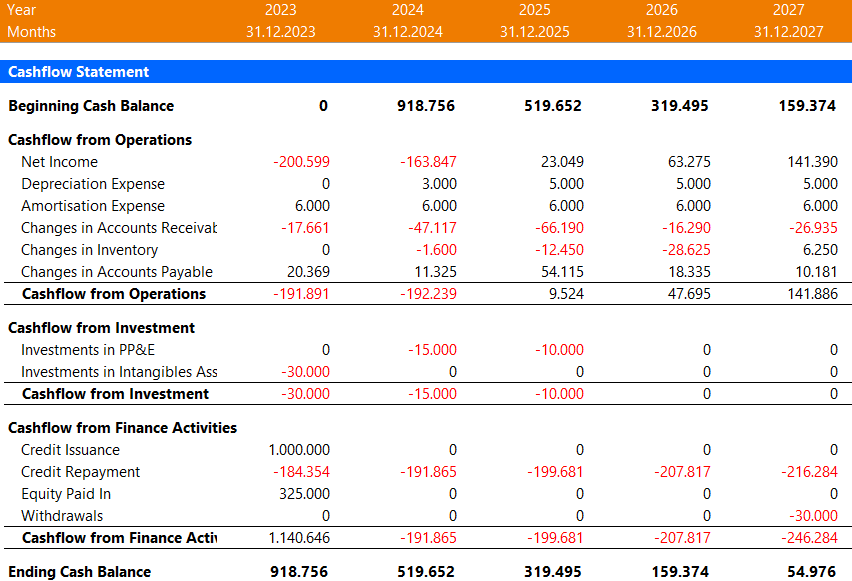

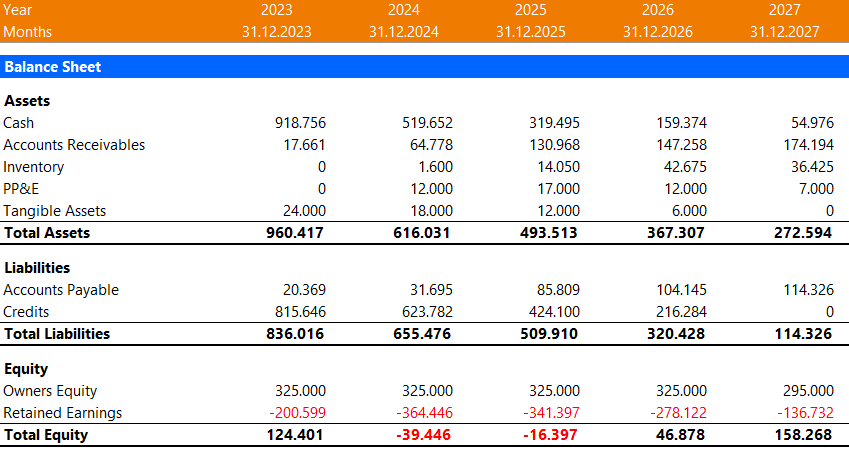

An example of a financial model for E-Commerce / Product Sales

We offer a finanical plan that is tailored to fit your specific business needs. During our initial consultation, we will assess your business model and create an financial plan that accurately reflects your operations. This may involve breaking down revenue into categories such as new client revenue, recurring customer revenue, and affiliate marketing revenue. Additionally, we will provide in-depth analysis of your inventory levels and consider factors such as depreciation of manufacturing equipment and warehouse equipment in the financial plan. We will also evaluate the staffing requirements for your operations and examine your cash requirements for each time period. Our services also include modeling of loans, convertible loans, and employee stock options.

Income Statement (very basic structure)

Cash Flow Statement

Balance Sheet

Further articles that we recommend:

https://levermann.com/financial-model/financial-statements-guide/

https://levermann.com/financial-analysis/financial-ratios-guide-101/

What is Financial Modeling?

I am a solo consultant who specializes in financial modelling. Financial modelling is not a tool or a spreadsheet; it’s more like a skillset.

How to Build a Three-Statement Financial Model

When we think about financial modeling, one of the most used tools to forecast the performance of a company is the three-statement financial model. Its relevance comes from many different factors, starting from its flexibility and customization to the fact that it is extremely useful both for startups and established companies.